Other than that, You may as well be rewarded for enhancing your Wellness Status by relocating from just one wellness degree to a different, According to the factors earned from on-line well being testimonials and each day and weekly Conditioning targets.

$$Tata AIA Vitality - A Wellness Program which offers you an upfront discounted at coverage inception. You may as well gain quality price reduction / cover booster (as applicable) for subsequent decades on coverage anniversary basis your Vitality Status (tracked on Vitality application) (2) Be sure to refer rider brochures For extra facts on wellness and wellness Gains.

The fund maintains adaptability to speculate in carefully chosen companies that offer chances across huge, mid or compact capitalization space

Remember to know the connected hazards along with the applicable charges, out of your insurance coverage agent or even the Intermediary or coverage document issued from the Insurance Company.

The assorted cash presented less than this contract are classified as the names of the cash and do not in any way reveal the quality of these designs, their foreseeable future potential clients and returns. On survival to the top in the plan time period, the whole Fund Price like Prime-Up Premium Fund Price valued at relevant NAV within the date of Maturity are going to be paid.

Discount is pushed by gathered factors that is attained by means of wellness position. You should refer coverage doc for more facts.

The client is suggested to refer the specific gross sales brochure of respective specific products and solutions pointed out herein in advance of concluding sale.

Tata AIA Vitality$$ is really a globally identified, holistic and science-based wellness method that assists you comprehend and improve your overall health when also gratifying you. The benefits could be in the shape of Price reduction on Top quality, Go over Booster and so forth.

and AIA Organization Minimal. The evaluation beneath the wellness method shall not be read this post here regarded as a healthcare assistance or simply a substitute to a consultation/therapy by an expert health-related practitioner.

ULIPs give existence insurance policy protection in addition to investment Advantages. Inside the occasion from the policyholder's premature demise, the nominee gets the sum assured or perhaps the fund value, whichever is bigger.

In ULIP, a percentage of the premium compensated with the policyholder is used for daily life insurance coverage coverage, though the remaining quantity is invested in several equity, financial debt or balanced funds as per the policyholder's preference.

Avail tax Positive aspects as per relevant tax legal guidelines Flexibility to pick from a number of best rated++ fund options starting from equity to credit card debt-oriented Cost-effective Premiums

Whilst just about every treatment is taken from the preparing of this content, it truly is subject to correction and marketplaces may not conduct in an analogous manner according to aspects influencing the money and financial debt marketplaces; hence this ad does not independently confer any lawful legal rights or responsibilities.

This is simply not an investment guidance, be sure you can find out more to make your individual independent final decision following consulting your money or other Skilled advisor.

ULIPs offer the flexibleness of selecting concerning distinct cash dependant on the policyholder's threat urge for food and share current market investment goals. The policyholder can switch amongst unique resources According to their financial plans and industry disorders.

The Time period Booster6 is yet another feature that enhances the protection of your respective coverage. In case the lifetime insured is diagnosed by using a terminal disease, they're going to acquire ten% of the sum confident beneath the lifestyle insurance policy policy.

ULIP means Unit Connected Coverage Prepare, which is a kind of insurance policy product or service that combines the key benefits of everyday living insurance policies and investment in a single approach.

The maturity profit supplied less than this policy is the overall fund value of your investment at 4% or 8%, as maturity7 amount of money like loyalty additions as well as other refundable prices, along with the return of each of the rates paid to the Tata AIA Vitality Secure Progress daily life insurance policy.

Ralph Macchio Then & Now!

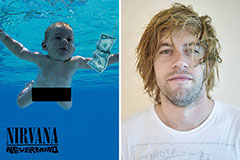

Ralph Macchio Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Michael J. Fox Then & Now!

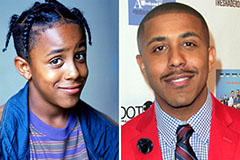

Michael J. Fox Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now!